Globalist financial agency also predicts inflation will continue to get worse and won’t be tamed by 2025.

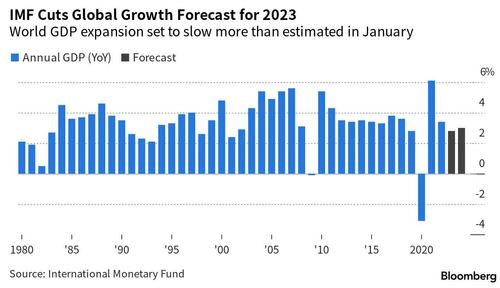

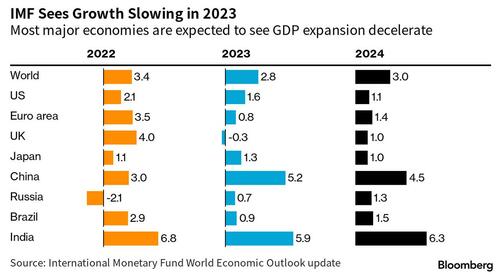

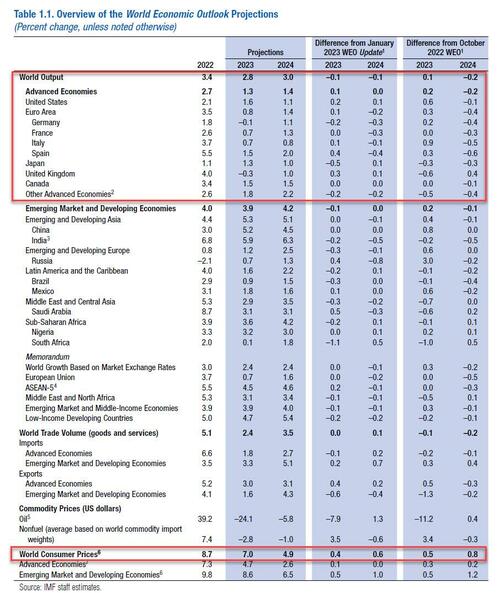

The IMF trimmed its global-growth projections in its latest World Economic Outlook report (link), warning of high uncertainty and risks as sticky inflation and financial-sector stress adds to pressures emanating from tighter monetary policy. GDP will likely expand 2.8% this year and 3% next year, each 0.1% less than forecast in January, the fund said in its latest forecast; That compares with 3.4% expansion in 2022. In a plausible alternative scenario with further financial sector stress, to which the IMF assigns a 25% probability, the IMF warns that global growth could decline to about 2.5% in 2023 with advanced economy growth falling below 1%.

Some highlights from the report:

- The fund raised its 2023 growth forecast for advanced nations marginally to 1.3%, 0.1% point higher than in the January forecast, boosted by strong labor markets. But that’s less than half the 2.7% expansion in 2022.

- The US is expected to grow 1.6%, 0.2% point more than in the prior projection

- The eurozone is expected to grow more slowly at 0.8 per cent this year as member states deal with last year’s energy price increases before recovering to a 1.4 per cent rate in 2024.

- China’s forecast growth rate of 5.2 per cent in 2023 from the IMF is in line with the Beijing government’s target, although the fund expects it to slow to 4.5 per cent in 2024.

- Japan’s forecast was cut to 1.3%, 0.5% point lower than in January, after a disappointing fourth quarter that’s expected to have carried into this year

- The IMF cut its growth expectations for emerging markets and developing economies — which have a bigger weighting than advanced nations based on purchasing-power-parity — to 3.9%, 0.1% point lower than its last projection

- The largest reduction among major economies was for South Africa, seen growing just 0.1%, down 1.1% point from the previous estimate

- The biggest upgrade was for Saudi Arabia, which the fund now predicts will expand 3.1%, 0.5% point higher than seen in January, boosted by large investment projects.

While the latest cuts in the 2023 forecast isn’t large, Bloomberg notes that the report showed the IMF is more subdued about the outlook than in January, when it saw this year as a “turning point” for the global economy and risks were more balanced.

Last week, the IMF warned growth over the next five years will be limited. That’s based on risks from economic fragmentation caused by geopolitical tension — including the escalating US-China rivalry that’s reinforced by the war in Europe — as well as slower labor-force growth and decelerating long-term rates of expansion in China and South Korea.

Additionally, in a new addition to the report, the IMF is now forecasting inflation; it projected that global headline inflation is set to fall from 8.7% in 2022 to 7.0% in 2023 but 0.4% higher than the January projection, on the back of lower commodity prices but underlying (core) inflation is likely to decline more slowly. Inflation’s return to target is unlikely before 2025 in most cases.

Here is a snapshot summary:

The unexpected failures last month of Silicon Valley Bank and Signature Bank and the collapse of Credit Suisse Group roiled markets and ignited financial-stability concerns, complicating central banks’ quest to tame inflation while maintaining growth and the health of the banking system, sparking IMF concerns about financial sector instability.

1776 around the world starts when you visit our store!

“The risks are weighted heavily to the downside, in large part because of the financial turmoil of the last month and a half,” said Pierre-Olivier Gourinchas, the fund’s chief economist. “That is under control as of now, but we are concerned that this could result in a sharper and a more elevated downturn if financial conditions were to worsen significantly.”

To that end, in one forecast scenario which it calls a “plausible alternative,” financial instability remains contained but impacts conditions more than in the IMF’s base case and banks reduce lending. That would cause growth to slow to 2.5% in 2023, the weakest pace since 2001, excluding the first year of the Covid-19 pandemic in 2020 and the global financial crisis of 2009.

In a severe downside scenario, to which the IMF assigns a 25% probability, there could be significant credit disruption, and the pace of global expansion could slow to less than 2% — something that’s only happened five times since 1970. There’s also about a 15% probability of growth at just 1%.

Gournichas told the Financial Times that, while the banking system was far more resilient than during the 2008 crisis, policymakers had to “think about what could go wrong”.

“We can all remember the long time between the failure of an individual institution, whether it was Bear Stearns or Countrywide,” he said, referring to institutions that failed more than a decade ago. “Every time, this was treated like an isolated incident, until it wasn’t.”

In its twice-yearly full forecasts published on Tuesday, the IMF said the turmoil in the UK government bond market last autumn and last month’s US banking turbulence showed the “significant vulnerabilities [that] exist both among banks and non-bank financial institutions”.

“Risks to the outlook are heavily skewed to the downside, with the chances of a hard landing having risen sharply,” the IMF said.

Additional risks beyond the financial sector include inflation taking longer than expected to slow, China’s reopening faltering, or a worsening of the Russia-Ukraine war. “We’re seeing a lot of downside risk going forward,” Gourinchas said.

Hinting that central banks are caught between a rock and a hard place, while on one hand it warns of financial stability risk brought on by sharp rate hikes, the IMF has also warned of a “hard landing” for the global economy if persistently troublesome inflation keeps interest rates higher for longer and amplifies financial risks.

Although the fund left its overall economic forecasts largely unchanged from January in its latest World Economic Outlook, published on Tuesday, it stressed that signs of resilience alongside lower global energy and food prices masked a darker reality. Gourinchas warned that “Below the surface . . . turbulence is building, and the situation is quite fragile”.

“Inflation is much stickier than anticipated even a few months ago,” he said. “More worrisome is that the sharp [monetary] policy tightening of the past 12 months is starting to have serious side effects for the financial sector.”

So long as financial markets remained relatively stable, central banks should do everything they can to beat inflation, the fund said. Gournichas warned price pressures could continue to prove more persistent, which would result in a “harder landing scenario”.

“There is a concern out there that we may not have enough tightening in the system at this point and more will be needed,” he said. “That would certainly increase the odds that output would come down further compared to our projections.”

However, a credit crunch, which some economists are predicting in the wake of the recent US banking turmoil, could act as a disinflationary force, he said. “As long as it is orderly, some of this lending contraction may actually be beneficial in terms of bringing down inflation and may substitute for further interest rate hikes,” Gournichas said.

More in the full report here.

Original Article: https://www.newswars.com/risk-of-harder-landing-imf-cuts-global-gdp-outlook-warns-of-heavy-downside-risks-due-to-banking-crisis/